Author: R&D Team, CUIGUAI Flavoring

Published by: Guangdong Unique Flavor Co., Ltd.

Last Updated: Jan 27, 2026

Modern GC-MS Laboratory Analysis

In the hyper-competitive landscape of the global food and beverage industry, a product’s sensory profile—its unique “flavor fingerprint”—is often its most valuable intangible asset. For professional manufacturers, flavor is not merely a commodity ingredient like sugar or flour; it is a sophisticated chemical system, a proprietary blend of volatile compounds designed to trigger specific neurological and emotional responses in consumers.

Because flavor is the primary driver of repeat purchases, the procurement of these substances represents a high-stakes intersection of food science, intellectual property law, and global logistics. Consequently, the legal and technical frameworks governing these transactions—flavor contracts—require a level of precision and foresight that goes far beyond standard purchasing agreements.

Securing favorable terms in a flavor supply agreement is a multidisciplinary exercise. It requires a synergy between procurement’s cost-efficiency mandates, R&D’s rigorous technical requirements, and legal’s risk mitigation strategies. Whether you are sourcing a signature natural extract or a high-intensity synthetic profile, the contract serves as the ultimate safeguard for your product’s consistency, your brand’s reputation, and your company’s bottom line.

A flavor contract is only as robust as its technical appendices. In the flavor industry, “quality” cannot be a subjective measure of taste; it must be a set of quantifiable, reproducible parameters that can be verified in a laboratory.

Every contract must include a detailed Certificate of Analysis (CoA) template that the supplier is mandated to provide for every single batch produced. Inconsistency in these metrics can lead to “off-notes” in the final beverage or, worse, separation and stability issues in the retail container. Key metrics that should be non-negotiable include:

While chemical metrics provide a baseline, they do not tell the whole story. Two flavors can have identical refractive indices but taste subtly different due to trace impurities. The contract must define a “Gold Standard” or “Target Sample”—a specific batch that both parties agree represents the ideal profile.

To prevent “flavor drift” (where the profile slowly changes over years of production), the contract should specify the use of the Triangle Test method (ISO 4120). This sensory protocol involves presenting three samples to a trained panel—two from the “Gold Standard” and one from the new batch—to see if a statistically significant difference can be detected. If the new batch is distinguishable, the contract must provide clear pathways for immediate rejection and replacement at the supplier’s expense.

The most contentious area in flavor negotiation is almost always the ownership of the formula. Because flavors are often protected as Trade Secrets rather than patents, the contract is the only document that defines who “owns” the taste.

Many manufacturers mistakenly assume that because they paid an R&D fee, they own the final formula. However, in the absence of explicit language, the flavor house often retains the rights to the specific chemical ratios and “hidden” components—the carriers, solvents, and emulsifiers—that make the flavor work.

Pro-Tip: Ensure your contract distinguishes between Background IP (what each party owned before the deal) and Foreground IP (what is created during the project). If the supplier insists on owning the formula to protect their “core technology,” you must negotiate a royalty-free, perpetual, and exclusive license to use that flavor for your specific product category. Alternatively, include a “buy-out” clause that allows you to purchase the formula for a predetermined fee if the supplier fails to meet performance KPIs or enters insolvency.

Natural flavor ingredients—such as vanilla beans from Madagascar, citrus oils from Florida and Brazil, or cocoa extracts from West Africa—are among the most volatile commodities on earth. They are highly susceptible to climate change, geopolitical instability, and shifting labor laws.

While a fixed price for 12 or 24 months is the procurement professional’s dream, it is rarely sustainable for high-value natural flavors. If the market price for a raw material triples, a supplier on a fixed-price contract may be tempted to “de-prioritize” your orders or, in extreme cases, file for Force Majeure. Consider these advanced pricing models instead:

For strategic, long-term partnerships, “Open Book” costing is becoming the gold standard. This allows the buyer to see the supplier’s actual raw material costs, manufacturing overhead, and an agreed-upon profit margin. This transparency eliminates the “uncertainty premium” that suppliers often bake into their quotes to protect themselves against future price hikes.

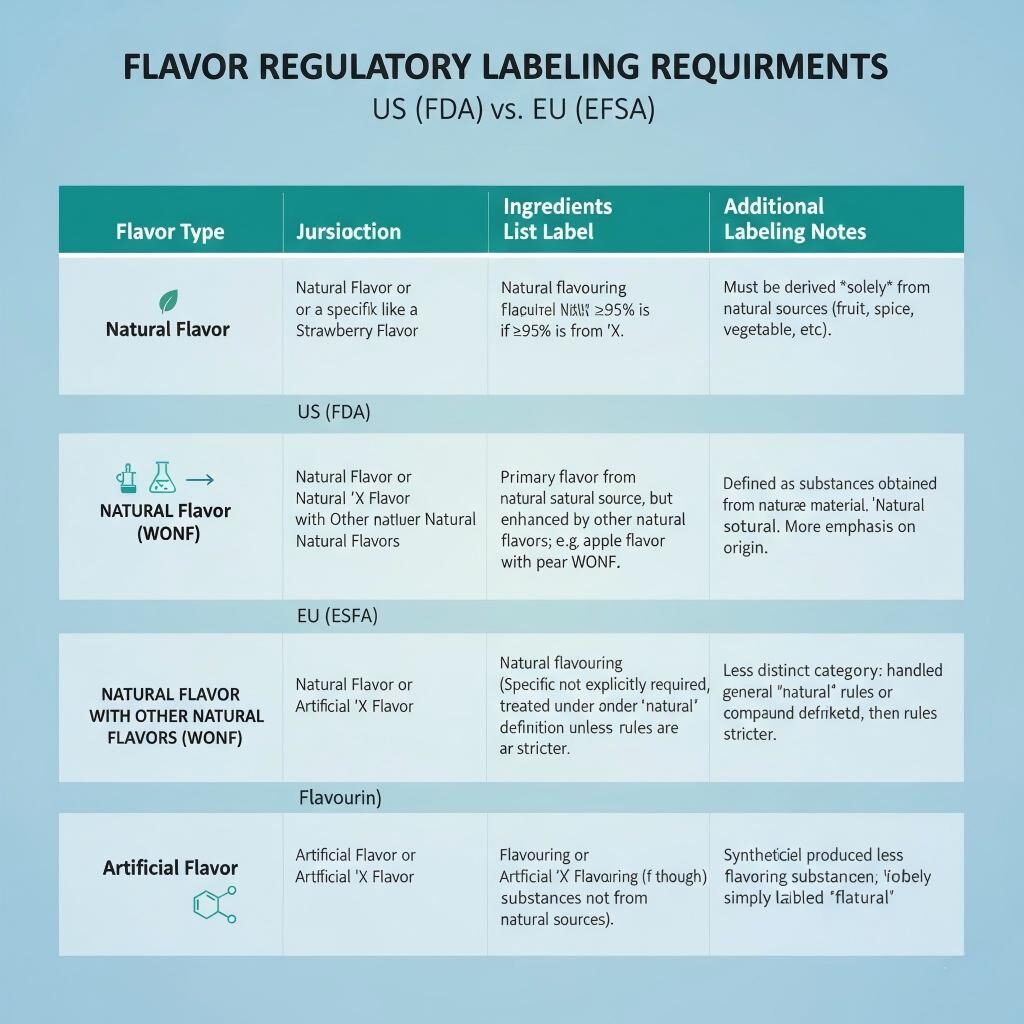

The regulatory environment for food and beverage flavors is a complex patchwork of national and international standards. A flavor that is legal in the United States may be banned or require different labeling in the European Union or China.

Your contract must mandate that the supplier provides and maintains up-to-date documentation for:

The “Flavor of the Month” can quickly become a “Regulatory Headache” if a specific chemical is reclassified. Your contract should include a clause requiring the supplier to notify you of any pending regulatory changes that might affect the “Natural” or “Clean Label” status of your flavor, and to provide a “reformulation roadmap” at minimal cost if a change becomes mandatory.

FDA vs EU Flavor Labeling Comparison

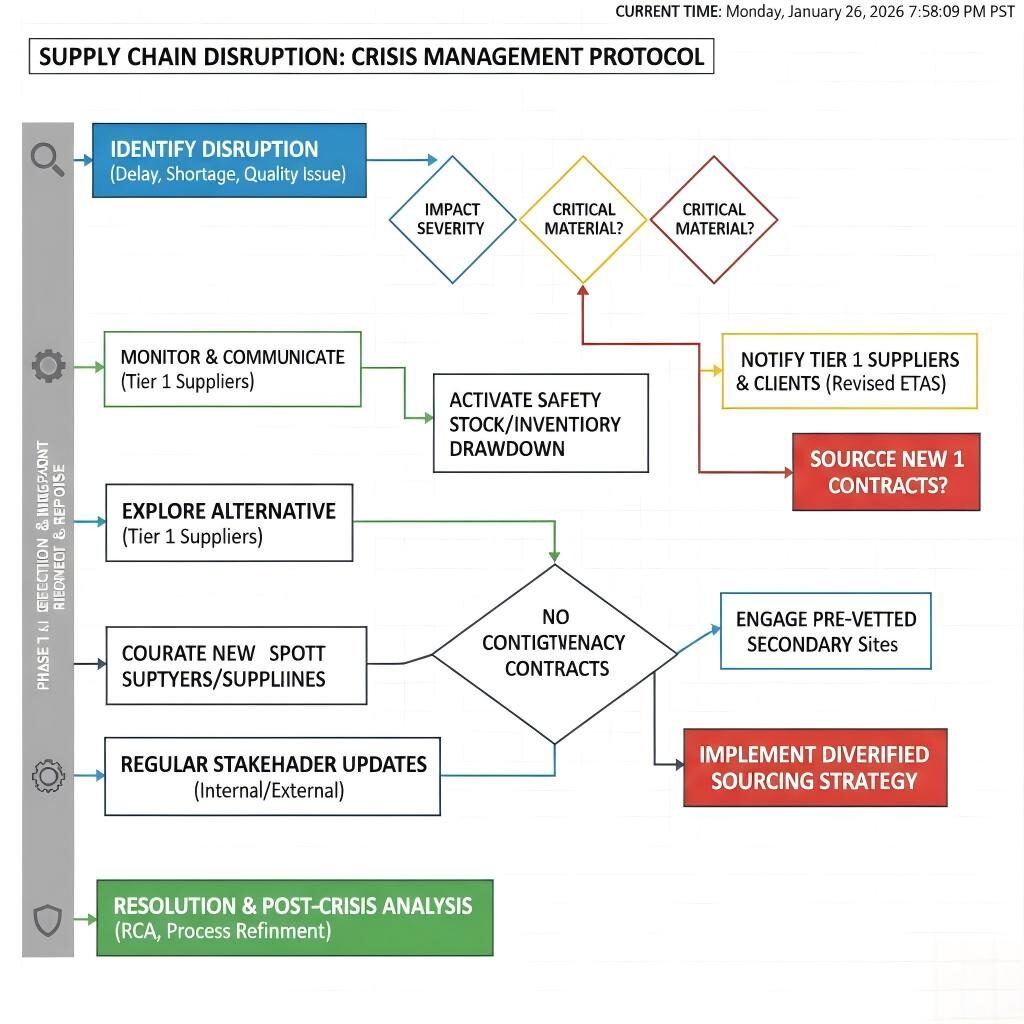

In a world of “just-in-time” manufacturing, a three-week delay in a flavor shipment can result in millions of dollars in lost revenue and strained relationships with retailers.

Specify “Standard Lead Times” in the contract (e.g., 10 business days from PO receipt). For custom-developed flavors, include a timeline for R&D samples and scale-up batches. To ensure accountability, include Liquidated Damages clauses. While “penalties” can feel aggressive, they are necessary to cover the actual costs of idle production lines and expedited shipping.

For your “A-item” flavors—those used in your top-selling SKUs—the contract should mandate that the supplier maintains a rolling safety stock (typically 4–8 weeks of forecasted demand) at their facility. This provides a vital buffer against logistics disruptions, port strikes, or sudden spikes in your own consumer demand.

Flavor houses prefer large production runs to maximize equipment efficiency. However, for niche products or Limited Time Offerings (LTOs), high MOQs lead to “dead stock” and expired ingredients. Negotiate MOQ Flexibility—perhaps by paying a slightly higher unit price for smaller batches, or by utilizing a “Make-and-Hold” agreement where the supplier produces a large batch but releases it in smaller shipments over several months.

The flavor industry is highly consolidated. Even a large flavor manufacturer may be a “blender” that sources high-impact aromatic chemicals from a handful of global chemical giants.

Supply Chain Crisis Flowchart

Most contracts are written with the excitement of a new partnership in mind, but the most critical clauses are those that handle the “divorce.” If you decide to move your business to a different flavor house—due to price, service, or quality issues—the transition must be seamless.

Include a Transition Services clause. This requires the current supplier to continue providing the flavor at the contracted price for a set period (e.g., 9–12 months) while you validate the new supplier. This prevents “hostage pricing,” where a disgruntled supplier spikes the price during your final months of partnership.

Most flavor contracts contain a strict “Non-Reverse Engineering” clause. While standard, you should attempt to limit this restriction so that you are permitted to analyze the flavor for safety, quality control, and regulatory compliance purposes. If you are the one who provided the initial “target profile” or “bench sample,” you should retain the right to have that profile replicated elsewhere if the supplier fails to perform.

If a batch of flavor doesn’t “taste right,” but the supplier points to a CoA showing every chemical metric is within range, you have a classic “Sensory vs. Science” dispute. Traditional litigation is too slow and expensive for the fast-moving F&B world.

The contract should mandate that in the event of a sensory dispute, both parties agree to send the samples to an independent third-party lab or a mutually agreed-upon Master Flavorist. Their decision on whether the batch meets the “Gold Standard” should be final and binding. This keeps the focus on the chemistry and organoleptic reality rather than legal posturing.

In 2026, consumer demand for ethical sourcing is no longer a trend; it is a requirement. Your flavor contract should reflect your brand’s commitment to sustainability.

Require suppliers to adhere to a Supplier Code of Conduct that covers:

At its core, a flavor contract is not about “winning” every point at the expense of the supplier; it is about creating a framework for long-term mutual success. A flavor house that is squeezed too hard on price will eventually be forced to cut corners on quality or will prioritize other customers during a global shortage. Conversely, a manufacturer that fails to protect its IP and supply chain is building its brand on a foundation of sand.

By focusing on technical precision, IP clarity, and supply chain resilience, you can secure terms that protect your brand’s sensory essence while ensuring the operational stability required to scale in a global market.

Premium Botanical Beverage Quality

Master Your Flavor Strategy Today.

Are you looking to optimize your beverage formulation, ensure regulatory compliance across global markets, or secure a more resilient flavor supply chain? Our team of veteran flavorists and technical procurement specialists is ready to collaborate.

| Contact Channel | Details |

| 🌐 Website: | www.cuiguai.cn |

| 📧 Email: | info@cuiguai.com |

| ☎ Phone: | +86 0769 8838 0789 |

| 📱 WhatsApp: | +86 189 2926 7983 |

| 📍 Factory Address | Room 701, Building 3, No. 16, Binzhong South Road, Daojiao Town, Dongguan City, Guangdong Province, China |

Schedule a Technical Exchange: [Book a 1-on-1 consultation with our R&D team to discuss your proprietary formula requirements and contract specifications.]

Journal of Food Science (IFT): Technical and Economic Drivers in the Global Sourcing of Natural Aroma Volatiles

Copyright © 2025 Guangdong Unique Flavor Co., Ltd. All Rights Reserved.